SEOUL: South Korean startup Rebellions Inc is launching an artificial intelligence (AI) chip Monday to win government contracts as Seoul seeks a place for local companies in the booming AI industry.

The company’s ATOM chips are South Korea’s latest attempt to challenge Nvidia Corp, the world leader in hardware behind potentially game-changing artificial intelligence technologies.

The tech world is talking about artificial intelligence as ChatGPT, a Microsoft-powered OpenAI chatbot that generates articles, essays, jokes, and even poems, became the fastest-growing consumer app in history within two months of its launch. UBS.

Nvidia, USA chip designer, has a commanding share of high-end AI chips, making up about 86per cent of the computing power of the world’s six biggest cloud services as of December, according to Jefferies chip analyst Mark Lipacis.

The South Korean government wants to foster a domestic industry, investing more than US$800 million over the next five years for research and development in a bid to lift the market share of Korean AI chips in domestic data centres from essentially zero to 80per cent by 2030.

“It’s hard to catch up to Nvidia, which is so far ahead in general-purpose AI chips,” said Kim Yang-Paeng, senior researcher at the Korea Institute for Industrial Economics and Trade.

“But it’s not set in stone because AI chips can carry out different functions and there aren’t set boundaries or metrics.”

Rebellions’ ATOM is designed to excel at running computer vision and chatbot AI applications.

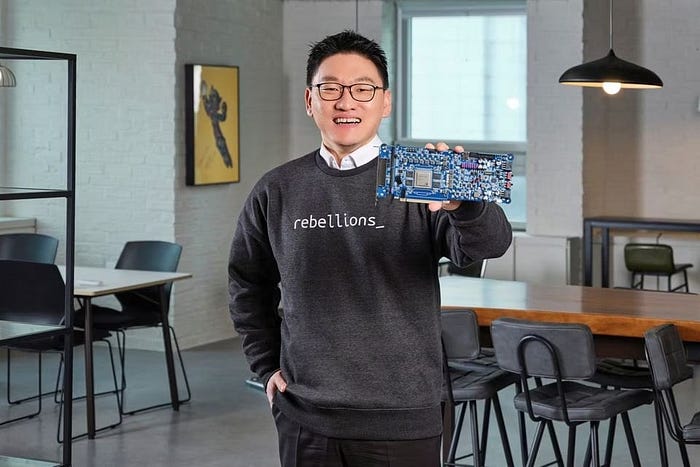

Because it targets specific tasks rather than doing a wide range, the chip consumes only about 20per cent of the power of an Nvidia A100 chip on those tasks, said Rebellions co-founder and chief executive Park Sunghyun.

A100 is the most popular chip for AI workloads, powerful enough to create — in industry lingo, “train” — the AI models. ATOM, designed by Rebellions and manufactured by Korean giant Samsung Electronics Co, does not do training.

While countries such as Taiwan, China, France, Germany and the United States have extensive plans to support their semiconductor companies, the South Korean government is rare in singling out AI chips for a concentrated push.

Seoul will put out a notice this month for two data centres, called neural processing unit farms, with only domestic chipmakers allowed to bid, an official at the Ministry of Science and ICT told Reuters.

‘TWISTING ARMS’

In a country whose firms supply half the world’s memory chips, the authorities want to create a market that can be a test bed for AI chipmakers, aiming to foster global competitors.

“The government is twisting the arm of the data centres and telling them, ‘Hey, use these chips’,” Rebellions’ Park, a former Morgan Stanley engineer, told Reuters.

Without such support, he said, data centres and their customers would likely stick with Nvidia chips.

Sapeon Korea Inc also plans to participate in the project, the SK Telecom Co subsidiary said.

FuriosaAI, backed by South Korea’s top search engine Naver Corp and state-run Korea Development Bank, told Reuters it will also bid.

“There is a lot of momentum behind Nvidia’s progress. These startups need to gain momentum, so it will take time,” said Alan Priestley, analyst at IT research firm Gartner. “But government incentives like what is happening in Korea can have a very large impact on market share in Korea.”

Rebellions is trying to join a government project in a consortium with KT Corp, a major South Korean telecommunications, cloud and data center operator, to take Nvidia customers out of the US producer.

Vice President Baekan of KT said, “In a world where global reliance on foreign GPUs (GPUs) is high, we will be able to secure a ‘complete AI stack’ including software and hardware based on domestic technology through collaboration between KT and Rebellions.” said — chul.

Rebellions rejected its predictions for the AI chip venture. The company raised 10 billion won, including 30 billion won from KT, in a funding round involving Singapore-based Temasek Pavilion Capital from the South Korean government.

Originally published at https://businessdor.com on February 13, 2023.

No comments:

Post a Comment